Breaking News

Hot Stories

Highlight Stories

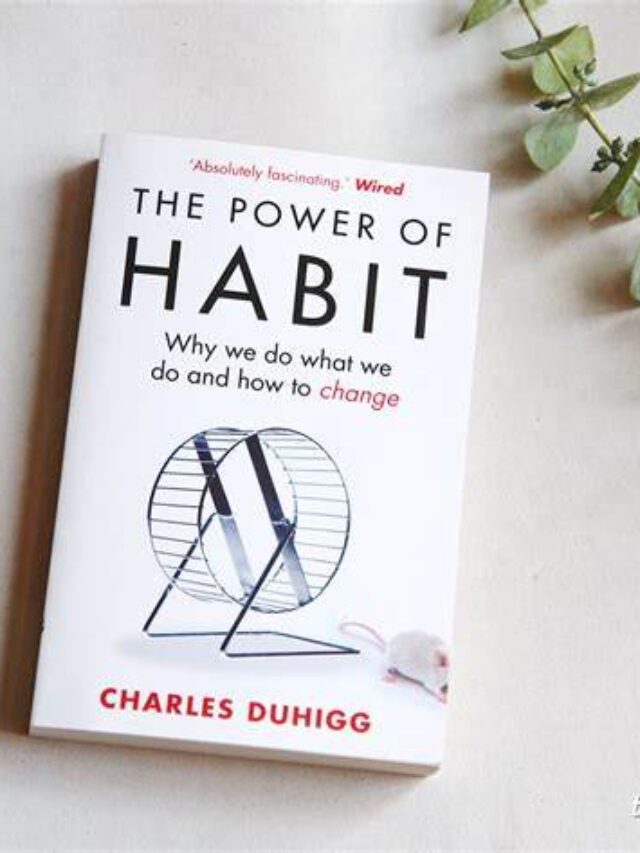

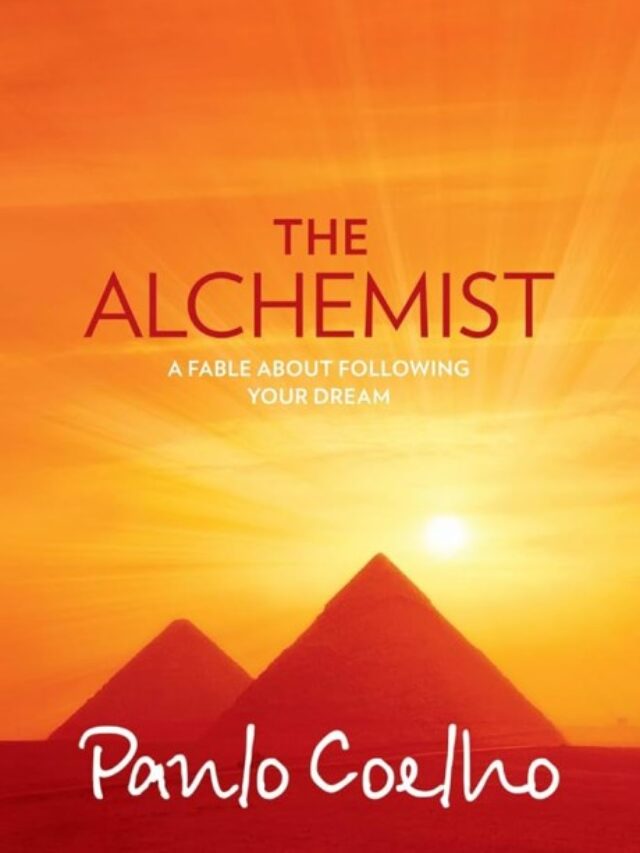

Top 5 best self development books to read in 2024

Do you want to become the best version of yourself and live a life full of discipline and success then…

Discover Categories

-

Discover More of What Matters to You:

- Science

- Life Style

- Videos

- Travel

- Entertainment

- Live Updates

- Wellness

- Wellness

- Uncategorized

- Digital Marketing

- Health

- Workout

- Exercise

- Motivation

Earth records its hottest 12-month stretch: US study

WASHINGTON: A new US study has found…

How much can trees fight climate change? Massively, but not alone, study finds

Restoring global forests where they occur naturally…

Unlocking Your Potential of being a high value women: Top 5 Habits of High-Value Women

Do you want to improve yourself? do…

What to Watch

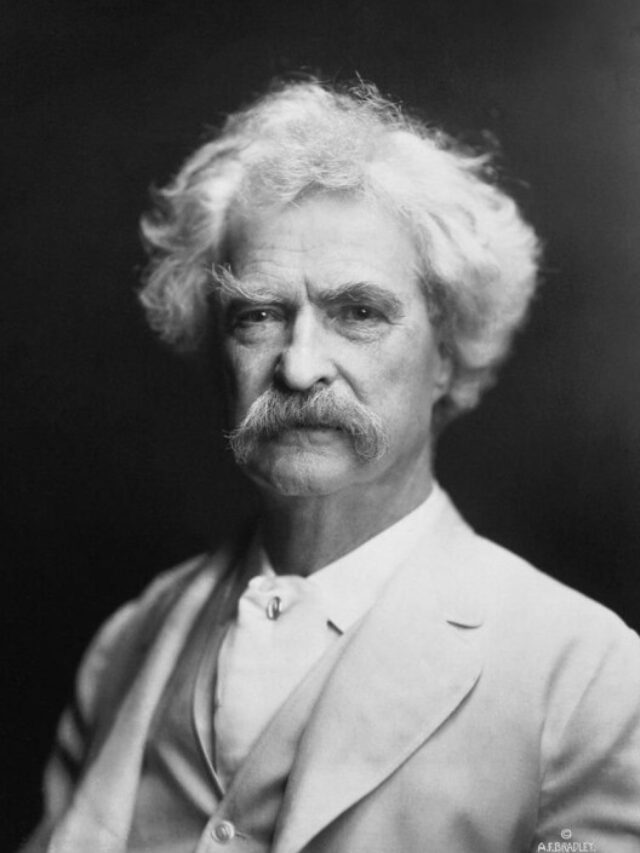

Why is Dostoevsky’s ‘White Nights’ all over social media; A look at the fyodor fever

By Onlinesyndrome

J.R.R. TOLKIEN’S BIRTH ANNIVERSARY: A LOOK AT HIS FAMOUS WORKS AND LEGACY

By Onlinesyndrome

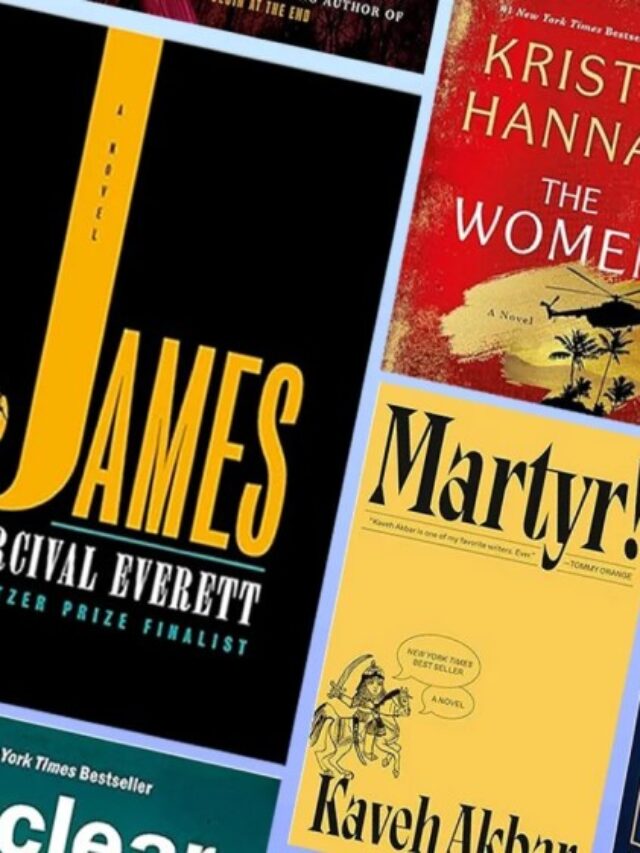

Top 10 novels in USA 2024

By Onlinesyndrome

William Shakespeare’s works are rich with lines that have become iconic over the centuries.

By Onlinesyndrome

These authors and their works significantly influenced the literary scene in 2024, engaging a wide audience across various social media platforms.

By Onlinesyndrome

- Advertisement -

Why is Dostoevsky’s ‘White Nights’ all over social media; A look at the fyodor fever

By Onlinesyndrome

J.R.R. TOLKIEN’S BIRTH ANNIVERSARY: A LOOK AT HIS FAMOUS WORKS AND LEGACY

By Onlinesyndrome

Top 10 novels in USA 2024

By Onlinesyndrome

William Shakespeare’s works are rich with lines that have become iconic over the centuries.

By Onlinesyndrome

These authors and their works significantly influenced the literary scene in 2024, engaging a wide audience across various social media platforms.

By Onlinesyndrome

10 Books People Claim to Have Read to Sound Cool

By Onlinesyndrome

8 Must-Read Thrillers

By Onlinesyndrome

8 books that will make you an expert in understanding human psychology and behavior

By Onlinesyndrome

Here’s a list of 10 magical books to captivate your child and spark a lifelong love for reading.

By Onlinesyndrome

Mastering Instagram Growth: Insights from an Expert

Expert Reveals Secrets to Mastering Instagram Growth: Boost Your Followers and Engagement with Proven Strategies for Success on the Popular…

From Agency Employee to 7-Figure Agency Owner

Agency to Empire: The Remarkable Journey of a Former Employee Becoming a 7-Figure Agency Owner. Uncover the steps and strategies…

- Advertisement -

Digital Marketing Agency For Showrooms In New York City

We will help your brand to get more customers in-store In New York City visits from our viral online marketing…

Follow US

Find US on Social Medias

Weekly Newsletter

Subscribe to our newsletter to get our newest articles instantly!

[mc4wp_form]

- Advertisement -

More Information:Covid-19 Statistics