Breaking News

Hot Stories

Highlight Stories

Discover Categories

-

Discover More of What Matters to You:

- Science

- Life Style

- Videos

- Travel

- Entertainment

- Live Updates

- Wellness

- Wellness

- Uncategorized

- Digital Marketing

- Health

- Workout

- Exercise

- Motivation

South Africa hope for fifth time lucky in Australia showdown

NEW DELHI: South Africa remain steadfast in…

Unlocking the Best in Netflix : 5 Must-Watch Shows on Netflix

Are you bored and looking for some…

What to Watch

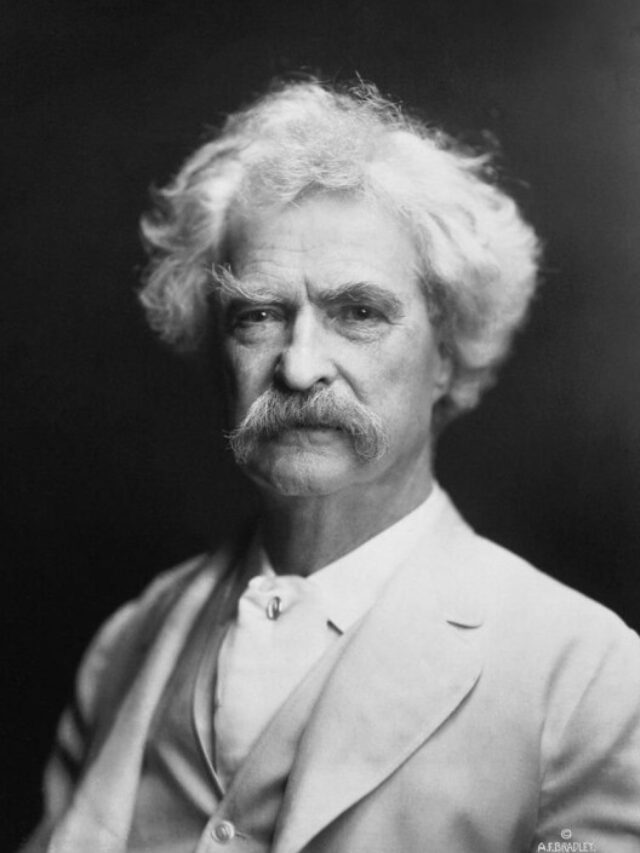

Why is Dostoevsky’s ‘White Nights’ all over social media; A look at the fyodor fever

By Onlinesyndrome

J.R.R. TOLKIEN’S BIRTH ANNIVERSARY: A LOOK AT HIS FAMOUS WORKS AND LEGACY

By Onlinesyndrome

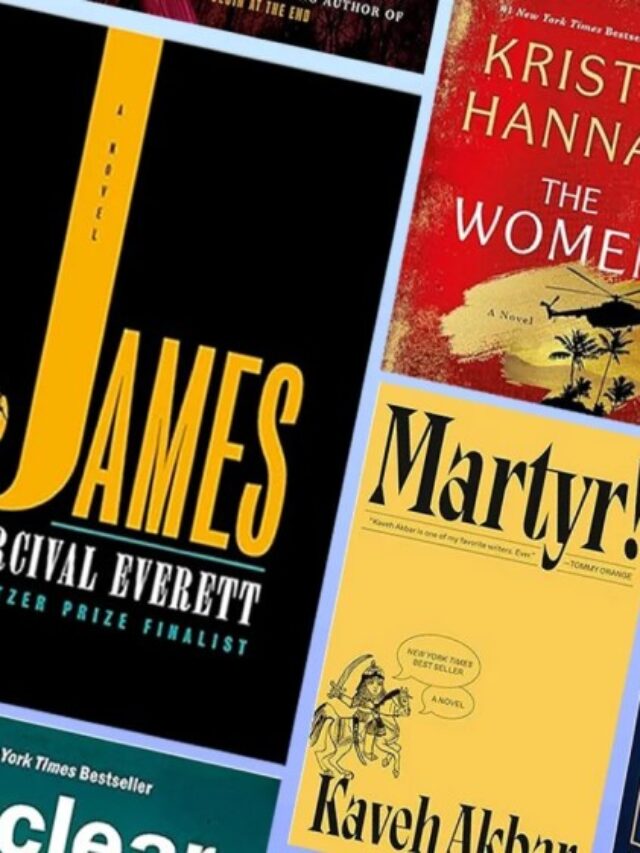

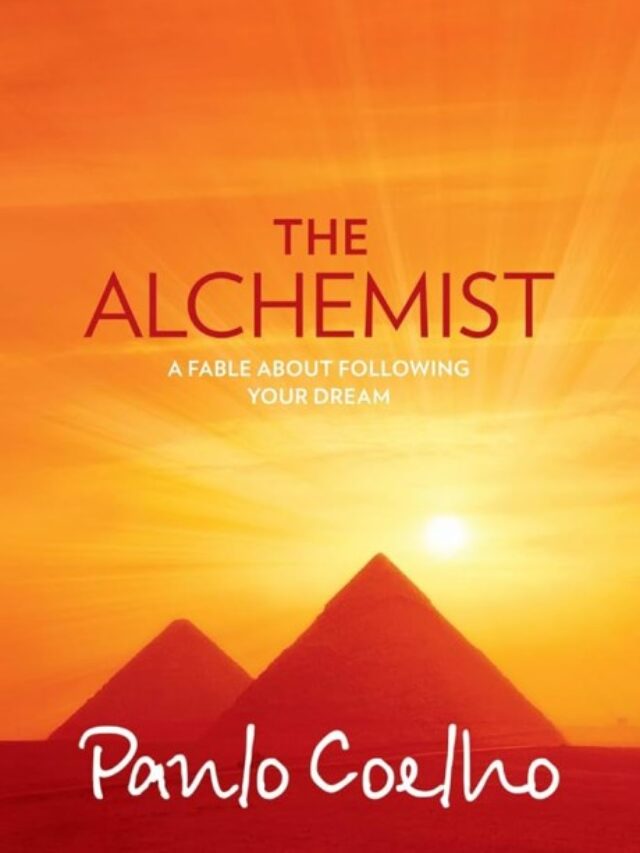

Top 10 novels in USA 2024

By Onlinesyndrome

William Shakespeare’s works are rich with lines that have become iconic over the centuries.

By Onlinesyndrome

These authors and their works significantly influenced the literary scene in 2024, engaging a wide audience across various social media platforms.

By Onlinesyndrome

- Advertisement -

Why is Dostoevsky’s ‘White Nights’ all over social media; A look at the fyodor fever

By Onlinesyndrome

J.R.R. TOLKIEN’S BIRTH ANNIVERSARY: A LOOK AT HIS FAMOUS WORKS AND LEGACY

By Onlinesyndrome

Top 10 novels in USA 2024

By Onlinesyndrome

William Shakespeare’s works are rich with lines that have become iconic over the centuries.

By Onlinesyndrome

These authors and their works significantly influenced the literary scene in 2024, engaging a wide audience across various social media platforms.

By Onlinesyndrome

10 Books People Claim to Have Read to Sound Cool

By Onlinesyndrome

8 Must-Read Thrillers

By Onlinesyndrome

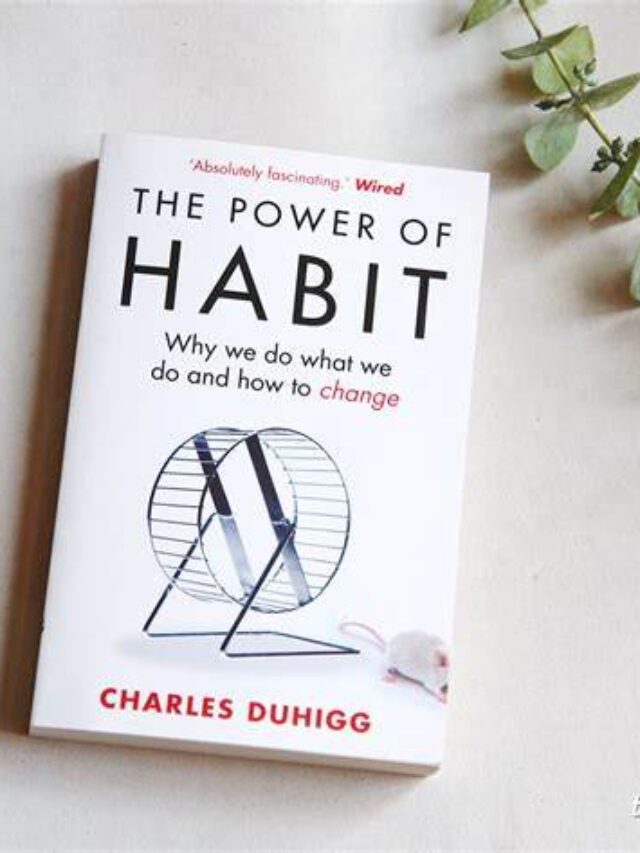

8 books that will make you an expert in understanding human psychology and behavior

By Onlinesyndrome

Here’s a list of 10 magical books to captivate your child and spark a lifelong love for reading.

By Onlinesyndrome

Thriving at 21: Insights from a Young YouTube Sensation

Young YouTube Star's Success at 21: Gain Insights into the Journey of a Thriving Content Creator. Learn the secrets behind…

Digital Marketing Agency For Showrooms In New York City

We will help your brand to get more customers in-store In New York City visits from our viral online marketing…

- Advertisement -

Startup Story of a 20-Year-Old Middle-Class Boy

Inspiring Startup Story: How a 20-Year-Old Middle-Class Boy Defied Odds to Build a Successful Business. Learn about his journey, challenges,…

Follow US

Find US on Social Medias

Weekly Newsletter

Subscribe to our newsletter to get our newest articles instantly!

[mc4wp_form]

- Advertisement -

More Information:Covid-19 Statistics